Ian Povey-Hall, Director - Sustainable Finance & Impact Investing at Acre, sat down with Energy Monitor to discuss the skill shortage in the finance sector. You can find the article below, or at the original source on the Energy Monitor Website.

Finance sector skills shortage puts ESG in focus | The explosion in sustainable finance is putting a premium on ESG expertise – and the market is scrambling to catch up.

Written by Mark Nicholls

05 May 2021

Assets are pouring into sustainable investment products. Companies are turning to their financiers to help them decarbonise. For financial institutions, ‘ESG integration’ is seeing consideration of environmental, social and governance factors become a central part of investment and risk processes, rather than an afterthought or a niche business.

These are symptoms of a wide-ranging cultural change that is bringing sustainability issues into the mainstream of the financial sector and creating demand for new skills and expertise that is currently outstripping supply.

“Five years ago, you were hard-pressed to find expertise in ESG anywhere outside big firms like Blackrock, State Street, or Barclays,” says Matt Orsagh, senior director of capital markets policy at the CFA Institute in Charlottesville, Virginia, US. Now it is “expected” across the financial sector, he says.

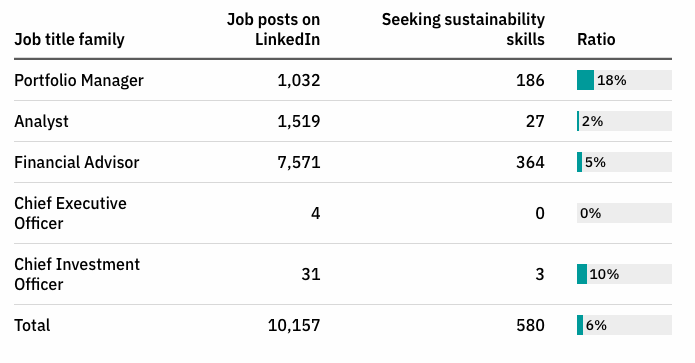

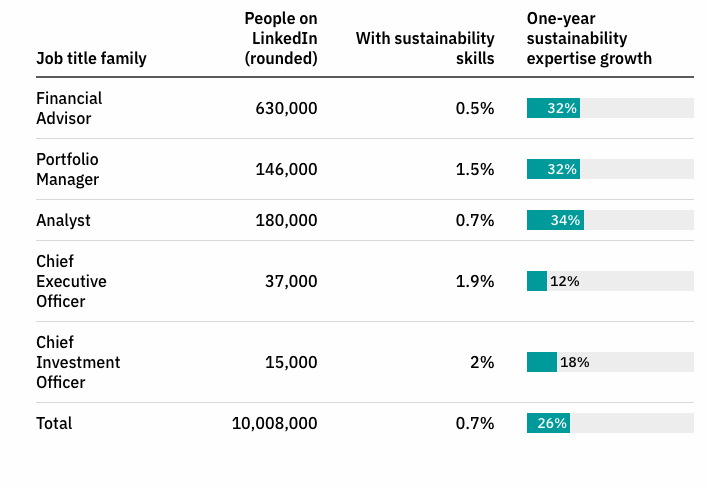

The CFA Institute has found a clear mismatch in supply and demand for sustainability-related skills within the finance sector. A review of more than 10,000 investment professional jobs posted on networking site LinkedIn last August found 6% mention such skills. However, analysis of the LinkedIn profiles of around one million investment professionals found that only 1% referenced sustainability skills – although that figure is rising fast.

Rising demand for sustainability skills

Percentage of job posts on LinkedIn specifying a need for ESG or sustainability skills.

There is growing demand both for a broad grounding in ESG issues, as well as for sustainability specialists in leadership roles. “There is an expectation that a 26-year-old analyst just out of business school will have a grounding in ESG,” Orsagh says. At the other end of the career ladder, a growing number of financial companies are looking for executives who can take a strategic view of sustainability issues.

Sustainability skills are rare but growing

Percentage of LinkedIn profiles mentioning sustainability-related skills.

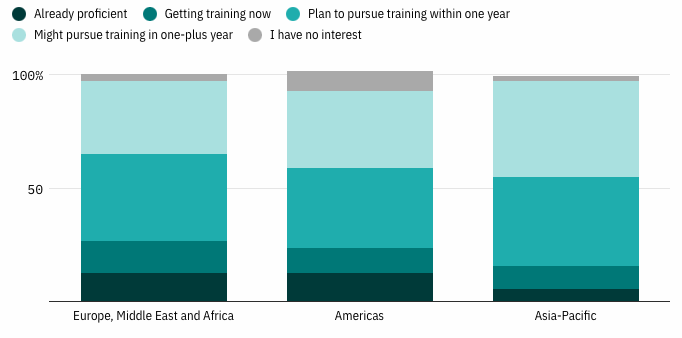

Investment professionals embrace ESG

Whether for mid-career individuals or those starting on their careers, universities, business schools and investment industry associations are acting to fill the ESG skills gap. In March, the CFA Institute – which awards the chartered financial analyst title – began offering an ESG certificate worldwide developed by its UK arm in 2019, following strong demand.

A thirst for ESG knowledge

Interest in building skills and knowledge regarding ESG analysis in investment practitioners, 2020

The course involves around 130 hours of self-study, followed by a computer-based exam. It is designed to help practitioners in investment roles learn how to analyse and integrate ESG factors into investment analysis. Likewise, it aims to help practitioners in other areas, such as sales and distribution, wealth management, product development, financial advice, consulting and risk, improve their understanding of ESG issues.

The idea is that a person with the certificate can “hit the ground running”, says Orsagh.

James Alexander, CEO of the UK Sustainable Investment and Finance Association, welcomes the introduction of such courses, “which give a good introduction to sustainable finance”. However, he nonetheless sees specific skills gaps, including on the trustee boards “of many pension funds, particularly smaller ones”.

He also detects shortcomings in the ability of investors to adequately include corporate ESG disclosures in investment decisions. “We are seeing more companies preparing [Task Force on Climate-related Financial Disclosure] reports and developing plans and strategies for Paris alignment,” says Alexander. “The value of these documents could be further enhanced if they formed a “central part of decision-making on investments.

“For this to happen, we need to ensure portfolio managers have the skills necessary to interrogate these documents effectively – we think there is likely to be a skills gap here,” he adds.

Spotting the gaps in ESG reporting

Some argue sustainable investment simply involves adding an additional layer of analysis to existing investment practice. However, Ian Povey-Hall, Director of Sustainable Finance at recruitment consultant Acre in London, believes it requires new ways of thinking. Investors “have to go the extra mile in looking for good-quality investments and reframing how they aim to deliver value for clients”, he says.

“Previously, it was all about bottom-line financials and cash flow modelling.” Now investors need to understand and value new indicators that may not be adequately reported by the companies involved, says Povey-Hall. “The skills gap lies in how investors can get better visibility on companies with imperfect data, often via engagement,” he explains. “A key differentiator in public markets comes from looking at a corporate report and working out what hasn’t been put in there and why.”

There is considerable demand from outside the finance sector for specialist skills that give investors additional insight into sustainability challenges, he adds. These skills might include impact measurement, geospatial mapping or be in emerging sectors such as the hydrogen economy, regenerative agriculture or natural capital solutions.

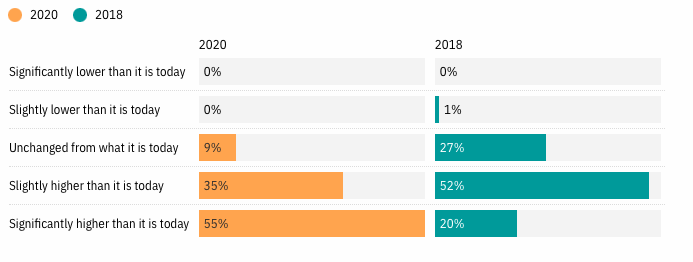

Investors' commitment to ESG research is accelerating

In the next five to ten years, I expect my firm's commitment to ESG and sustainability research will be:

Some warn of a dearth of appropriate skills in sustainable investing – particularly expertise in the natural sciences. The growing importance of non-financial data, and the unreliability of much self-reported corporate ESG data, means sustainable finance teams need experts who can understand and analyse raw ESG information and interpret its financial materiality, argues Kim Schumacher from the Tokyo Institute of Technology in Japan.

How the finance sector adapts to demand for sustainability expertise from its clients – whether end-investors or the companies that it supplies with capital – has analogies with earlier emerging trends. The CFA Institute report likens the evolution of ESG integration to the evolution of risk management as a distinct function within financial institutions. Penny at Heidrick & Struggles compares it with the emergence of the digital economy 20 years ago; what was once a highly specialist economic theme is now an integral part of all but the smallest company’s operations.

The logical end point, some believe, is that these specialist roles disappear as sustainability issues are integrated into business and finance – especially at the leadership level. “It may be that in ten years’ time we won’t have chief sustainability officers because their skills will have become ingrained in organisations,” says Penny. For the time being, however, demand is high and investment in this talent pool, at least until now, has been low.